Hey there! So I’ve decided to write a brief overview of why you might need to check out yet another expense tracker, called Menot.

Overall opinion on expense tracking

Here’s the thing, I realize that expense tracking isn’t for everyone, especially when most of the bank apps provide more than an overwhelming amount of data for you to analyze finances. Now, imagine that you’re not a US citizen and living abroad (I know this might be hard but just try). Also, you work remotely and get paid in USD but you spend it in local currency. Technically, at this point, a bank app would still be enough, as long as you use one bank app and the country you are in is primarily fine with bank cards as a payment.

That’s where things get interesting, if you add to that equation traveling to a new country every couple of months, and therefore currency conversions and cash. You’d also want to add crypto, as this is how you get paid for some of your freelance work. Now it’s absolutely impossible to track all that with a bank app.

Going back to the beginning, I’ve never found much use in manual expense tracking, as it seemed too boring, and time-consuming. I didn’t see any extra value in that. Until I had to face all of those extra details I mentioned above. I still don’t find much use in creating budgets for specific purposes or seeing the whole net worth, including investments and real estate. All I needed was to be able to see how much money I currently have if yesterday I bought a plane ticket for USDT on Travala, a week ago received compensation in EUR on PayPal, and today bought groceries for cash in Manila, Philippines. And what I found out is that there’s no way to do that unless I set up super elaborate Google Sheets with currency conversions and scraping for crypto prices as well.

The reasons behind making a simplistic finance tracker

I don’t suppose I’m the only person in the world who actually uses crypto as a means of payment and who travels a lot, that’d be absurd. This is why I’ve decided to make Menot. I do not care for the categories I spend money on, i.e. groceries, restaurants, travel expenses, etc. I do not care about setting up budgets or an investment portfolio. But this is exactly what all the other apps to track finances do, they all try to be an all-in-one solution for everything. I’ve tried quite a few of them, however always had to come back to Google Sheets as most of the time their interface is just impossible to navigate, there’s just too much going on. I feel like this is the wrong way to go about it.

In general, it is a very trivial problem, just show me how much I have if I spend this much in currency A via payment method B. Maybe it’s just my problem but I wasn’t able to set up any of the existing expense trackers to just do this one very simple task, yet they all let you set up a whole bunch of unnecessary BS.

How does Menot solve this

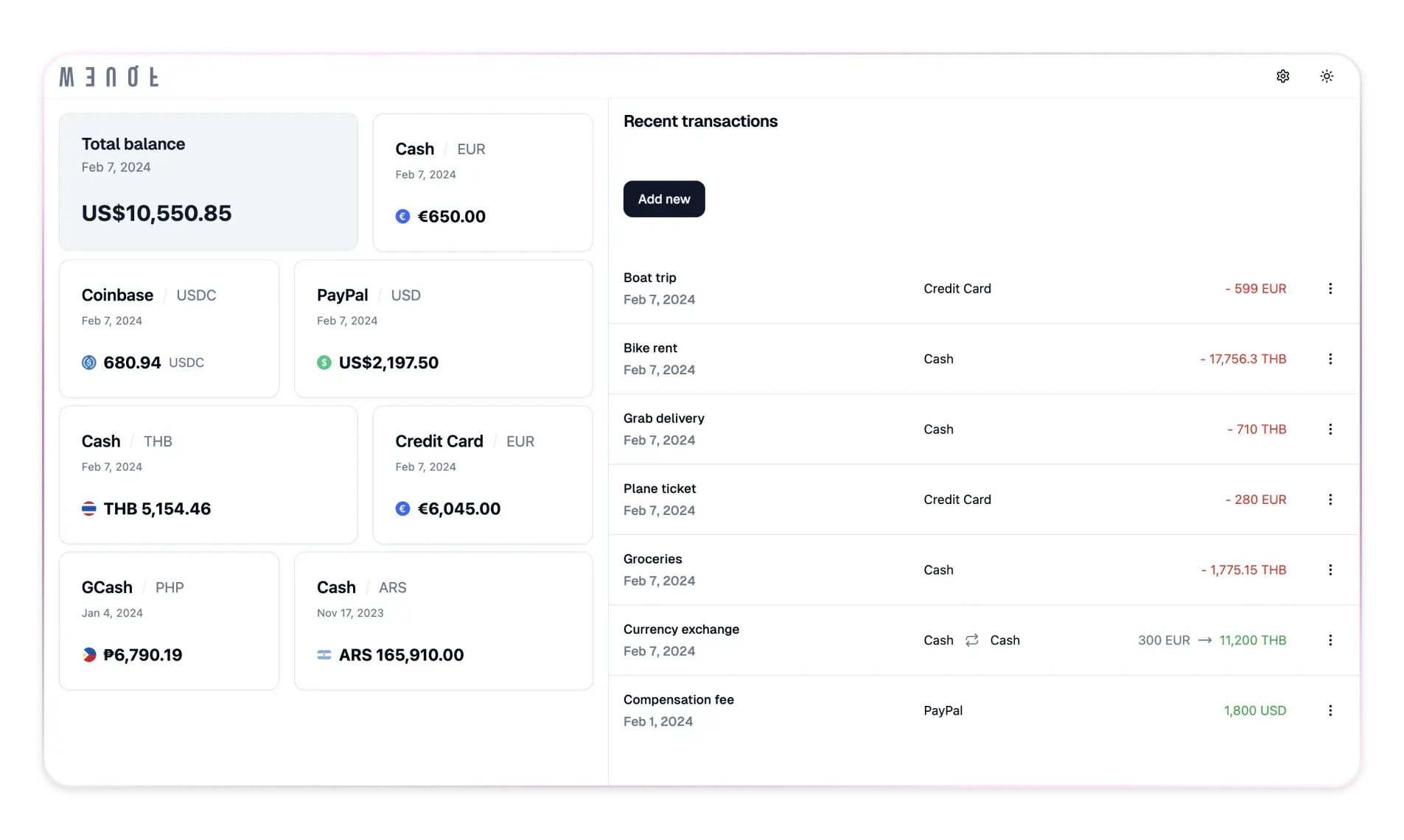

The idea is simple, make transactions, i.e. expense, income, or currency exchange in whatever currency or crypto yet see the clear total in USD. That’s exactly what Menot does.

Set up your current payment methods

When you launch the app for the first time, it’ll ask you to set up the first payment methods. By payment methods we mean anything that you are able to pay with. This can be cash, PayPal, bank card, crypto wallet or an exchange, some local payment provider, or even intergalactic credits (if they have a quote value of course). The transactions that you will later on add will be linked to payment methods you set up.

Add initial balance

The next step is to add the initial balance to your payment methods. Generally, it would make sense to set it up to what you currently have in each payment method.

Start tracking transactions

That’s it, once you add your initial balances you will see them all converted to USD in the top left corner as well as each one individually will also have USD quote shown. Now you can add transactions, which can either be an expense, income, or exchange between two payment methods. When you add a transaction it is directly linked to a payment method, making it clear to see what you paid for and how it was paid.

Current limitations

Since the app is in its early stages some bugs are to be expected. Also, the current functionality is very minimal and even though it was intentional, I do plan on adding more features while preserving the simplistic UI. If you do happen to notice some issues, bugs, or just have a suggestion do not hesitate to reach out [email protected]

Outro

I honestly believe that this has the potential to significantly simplify how digital nomads, freelancers, travelers, and expats track their finances. Most likely, you don’t need all those bells and whistles and just want to clearly see how much you have and how much you spend.

Eli Boch

Creator of Menot